ohio sales tax exemption form reasons

Purchaser must state a valid reason for claiming exception or exemption. 573902 B 42 g provides an Ohio sales tax exemption when the purpose of the purchaser is to use the thing transferred primarily in a manufacturing operation to produce tangible personal property for sale.

Schell Scenic Studio Inc Columbus Oh 614 444 9550 Online Forms

You will need to state a reason for the exemption which would be that the item is being purchased to be used in the manufacturing of tangible personal property for sale.

. Exempt Items Sales of certain items are exempt from sales and use tax. State of Ohio Created Date. Sales and use tax.

The blanket certificate exempts all purchases from sales tax for that vendor so use this form carefully if you purchase taxable items from the same vendor. A completed form requires the vendors name the reason claimed for the sales tax exemption and the purchasers name address signature date and vendors number if the purchaser has one. Failure to specify the exemption reason will on audit result in disallowance of the certificate.

Complete Edit or Print Tax Forms Instantly. Construction contractors must comply with rule. Exemption refers to retail sales not subject to the tax pursuant to division B of section 573902 of the Revised Code.

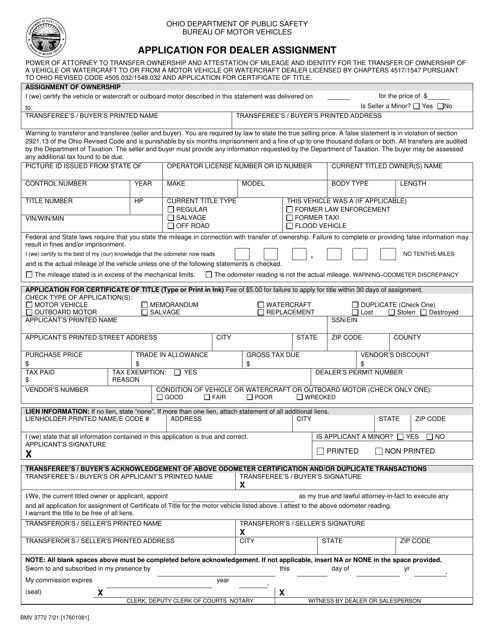

1 if a vendor seller or consumer is purchasing a motor vehicle a watercraft that is required to be titled or an outboard motor that is required to be titled and is claiming exemption from the sales and use tax based on a reason other than resale the vendor seller or consumer must comply with rule 5703-9-10 or 5703-9-25 of. Ad Fill out a simple online application now and receive yours in under 5 days. Sales and Use Tax Blanket Exemption Certificate.

The temperature graphing device which records the temperature data is taxable since it functions as a recordkeeping device. NR Non-Resident Affidavit Sales to non-residents of Ohio where the purchaser takes possession of the vehicle in Ohio but states the vehicle will be immediately removed and titled outside of Ohio are generally exempt from sales tax. For other Ohio sales tax exemption certificates go here.

Unless Ohio tax code exempts them all retail sales are subject to sales and use tax. Ad Access Tax Forms. Items that Qualify for Exemption Control and Support Example Answers.

The control booth and the equipment and controls in it are not taxable. An example reason for the purposes of completing the form could read purchases used for agriculture horticulture or floriculture production. The Ohio state sales tax rate is 575 and the average OH sales tax after local surtaxes is 71.

Exemption certificate forms A As used in this rule exception refers to sales for resale that are excluded from the definition of retail sale by division E of section 573901 of the Revised Code. Vendors name and certifi or both as shown hereon. Microsoft Word - Sales Tax Exemption Formdoc.

Step 3 Describe the reason for claiming the sales tax exemption. This may be done by circling or underlining the appropriate reason or writing it on the form above the state registration section. Use tax must be paid on all purchases made by Ohio residents and businesses if the proper amount of sales tax has not been paid to the vendor seller or service provider.

Purchaser must state a valid reason for claiming exception or exemption. Purchasers name Purchasers type of business Street address City state ZIP code Signature Title Date signed Vendors license number if any. You can use the Blanket Exemption Certificate to make further purchases from the same seller without having to give a newly completed form every time.

Real property under an exempt construction contract. Purchaser must state a valid reason for claiming exception or exemption. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

The sensors in the furnace monitor production and are not taxable. The buyer must specify which one of the reasons for exemption on the certificate applies. What is Ohio State tax exemption.

City state ZIP code. Groceries and prescription drugs are exempt from the Ohio sales tax. Ohio Revenue Code Ann.

Purchasers name Street address City state ZIP code Signature Title Date signed Vendors license number if any Vendors of motor vehicles titled watercraft and titled outboard motors may use this certificate to. One of the main reasons for the use tax is to protect Ohio vendors from unfair. Purchases that are properly exempt from sales tax are also exempt from the use tax.

Taxable sales include all transactions in which one entity transfers possession of tangible property or a title to property to another entity for a price. The purchaser will submit an affidavit STEC NR as documentation of this transaction.

Easily Verify Your Tax Exemption Certificates Exemptax

Form Bmv3772 Download Printable Pdf Or Fill Online Application For Dealer Assignment Ohio Templateroller

Form Stec U Fillable Sales And Use Tax Unit Exemption Certificate

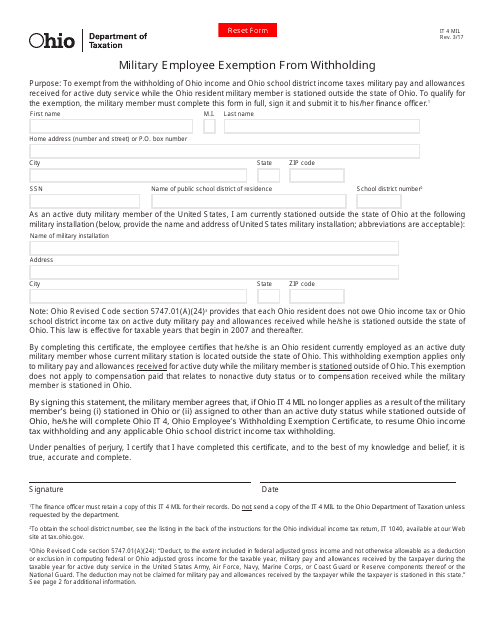

Form It4 Mil Download Fillable Pdf Or Fill Online Military Employee Exemption From Withholding Ohio Templateroller

Easily Verify Your Tax Exemption Certificates Exemptax

How To Get A Sales Tax Exemption Certificate In Arkansas Startingyourbusiness Com

Religious Exemption Form Texas Fill Online Printable Fillable Blank Pdffiller

Printable North Carolina Sales Tax Exemption Certificates

Estimated Payments Department Of Taxation

Ohio Sales Tax Exemptions Agile Consulting Group

The Taxes You Don T Pay All 127 Exemptions From Ohio State Taxes Cleveland Com

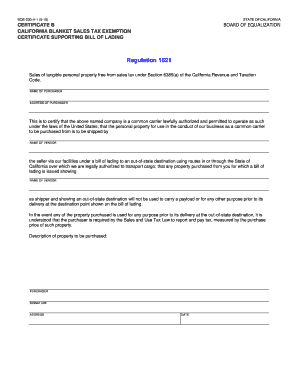

2015 Form Ca Boe 230 H 1 Fill Online Printable Fillable Blank Pdffiller